The Umby journey begins with plastic bottles and ends with umbrellas that provide insurance to families. The story of each of our products in unique -- but it always begins with you and ends with a family in need.

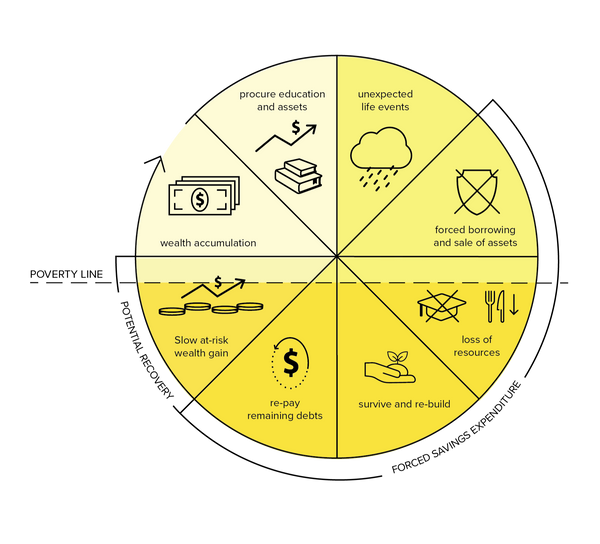

NON-INSURED FAMILY

The Pereras

Faced with a drought, the Pereras were unable to grow crops on their land this season. As a result they borrowed money at a high interest rate, sold their goat and stopped sending their children to school in order to find a way to survive until the next planting season.

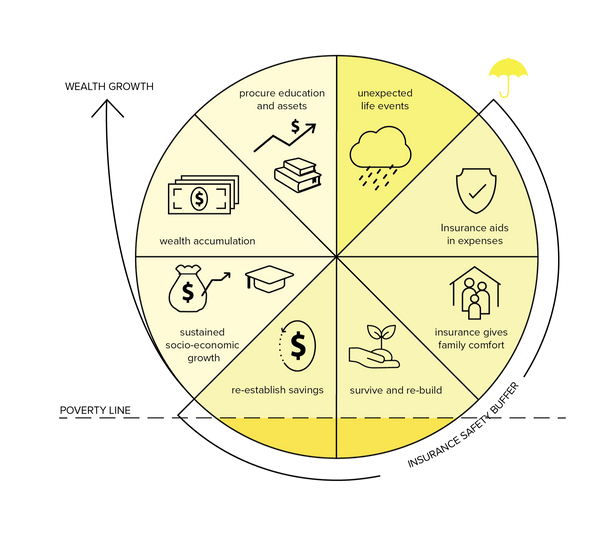

INSURED FAMILY

The Valencias

Faced with a unexpected health condition, one of the Valencia parents needed urgent medical attention.

The Valencias A Success Story

Low-income families live in extraordinarily risky circumstances where illness, loss of property, agricultural losses and disasters can easily push a family into poverty. If the Valencias did not have insurance, they would have had to pay the hospital fees. The bill would have been equal to three months income for the family. This large amount would only be possible by a high-interest loan and selling assets.

Fortunately, the Valencias had access to affordable health insurance which not only paid for the hospital fees, but also reimbursed the lost income of the patient during their recovery.

Fortunately, the Valencias had access to affordable health insurance which not only paid for the hospital fees, but also reimbursed the lost income of the patient during their recovery.

FOOD SECURITY

FOOD SECURITY

Agriculture insurance provides protection against drought, rainfall changes, pest invasion and crop failure so that a family can continue to have access to food, education and housing while they prepare for the next season.

LIVELIHOOD

LIVELIHOOD

Often a family will sell assets connected to their livelihood (such as livestock, transportation, or machinery) in the face of a crisis. Insurance protects those assets and allows a family to secure their livelihood and income when illness and disaster strike.

HEALTH CARE

HEALTH CARE

Health insurance provides protection against hospital fees, transportation costs, medicines and doctor visits. With health insurance, families are more inclined to participate in preventative health care and can manage the cost in times of illness.

EDUCATION

EDUCATION

Removing children from school is often a families only option to reduce costs when needed. With insurance, a child's educational experience becomes secure and the family can be ease with a safety net when they need it.

HOUSING

HOUSING

As both a signifiant asset and basic need, housing can often fall victim to natural disasters. With insurance, families can secure their access to housing and feel more confident in investing in their home.

INVESTING FOR THE FUTURE

INVESTING FOR THE FUTURE

Insurance provides families with security in the face of constant uncertainty. Having a safety net, allows families to plan for and invest in the future.

Preventing families from sliding into poverty

Lily

"I love that my yellow umbrella brightens my rainy days and also brings sunshine to families when they need it most."

The Lagharis

Our model begins with creating protection products that have meaning. Your purchase is creating a movement for protection.

OUR GIVING PARTNERS

KENYA

Supporting crop insurance for women farmers in Kwale, Kenya

MALI

Supporting crop insurance for sesame farmers in Koulikoro, Mali

MALAWI AND TANZANIA

Supporting health insurance for families in Malawi and Tanzania